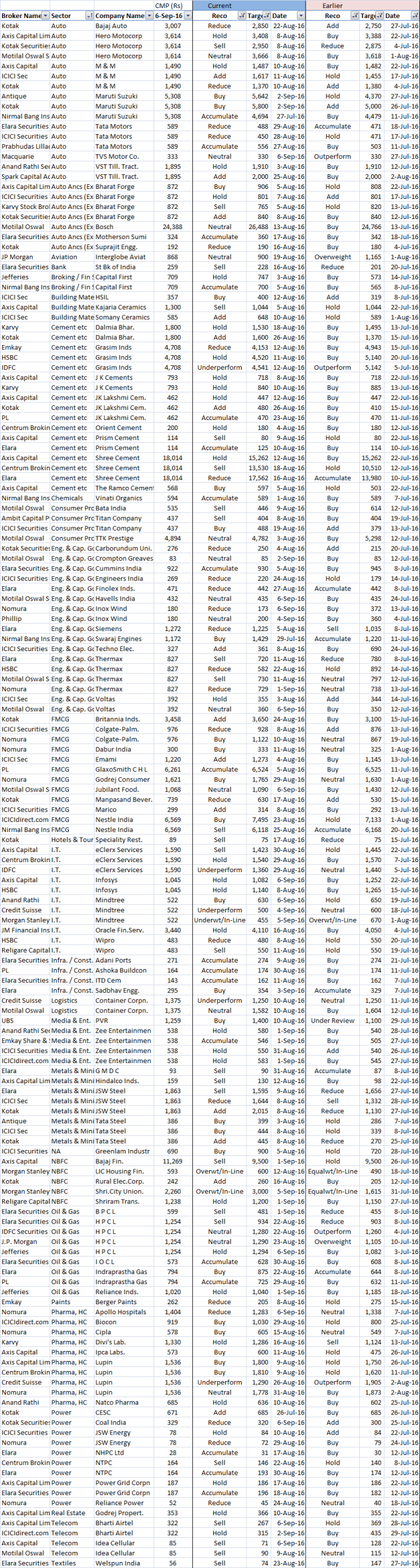

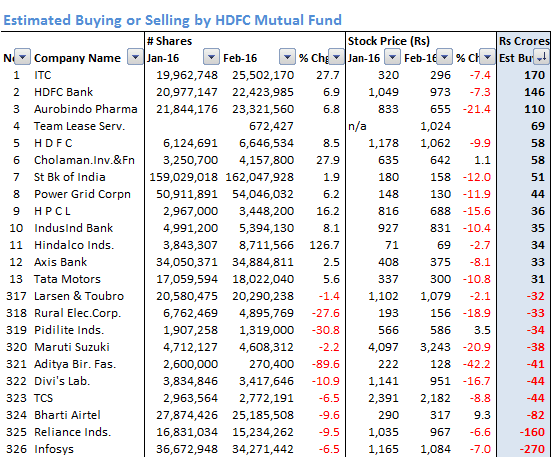

Almost all mutual fund managers comes on CNBC TV 18 and offer their expert advice on markets. They have standard disclaimer that they cannot discuss specific companies to buy and sell, but they talk a lot about a particular sector and macro economic trends, leading individual investor confused as to which stock to buy or sell after their expert advise.

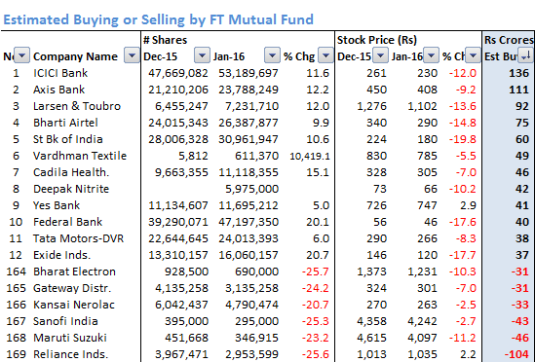

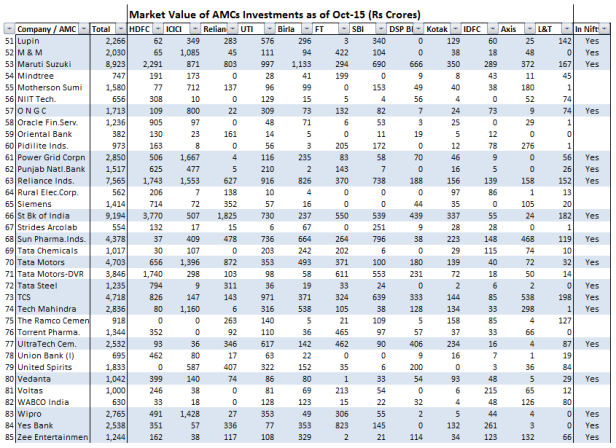

So I decided to compare ICICI pru’s Dec-17 portfolio with May-18, to get where these brilliant mind are putting money.

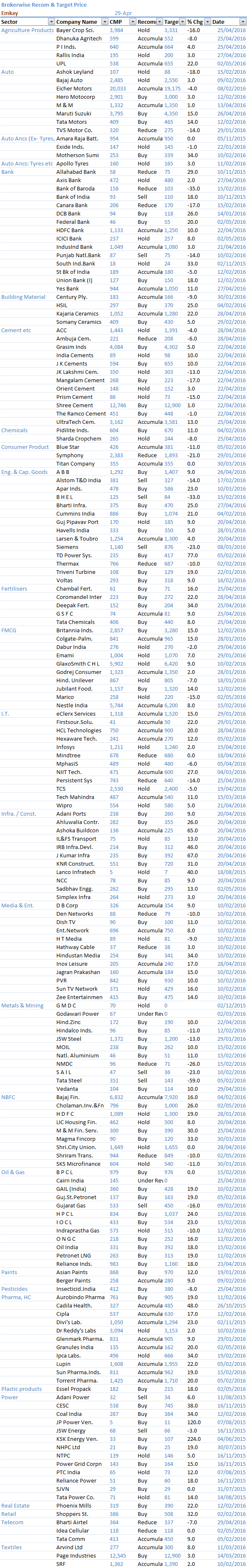

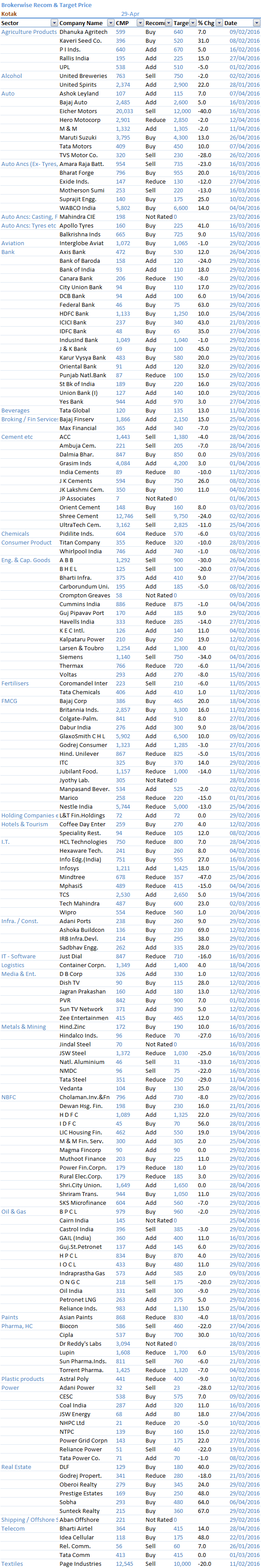

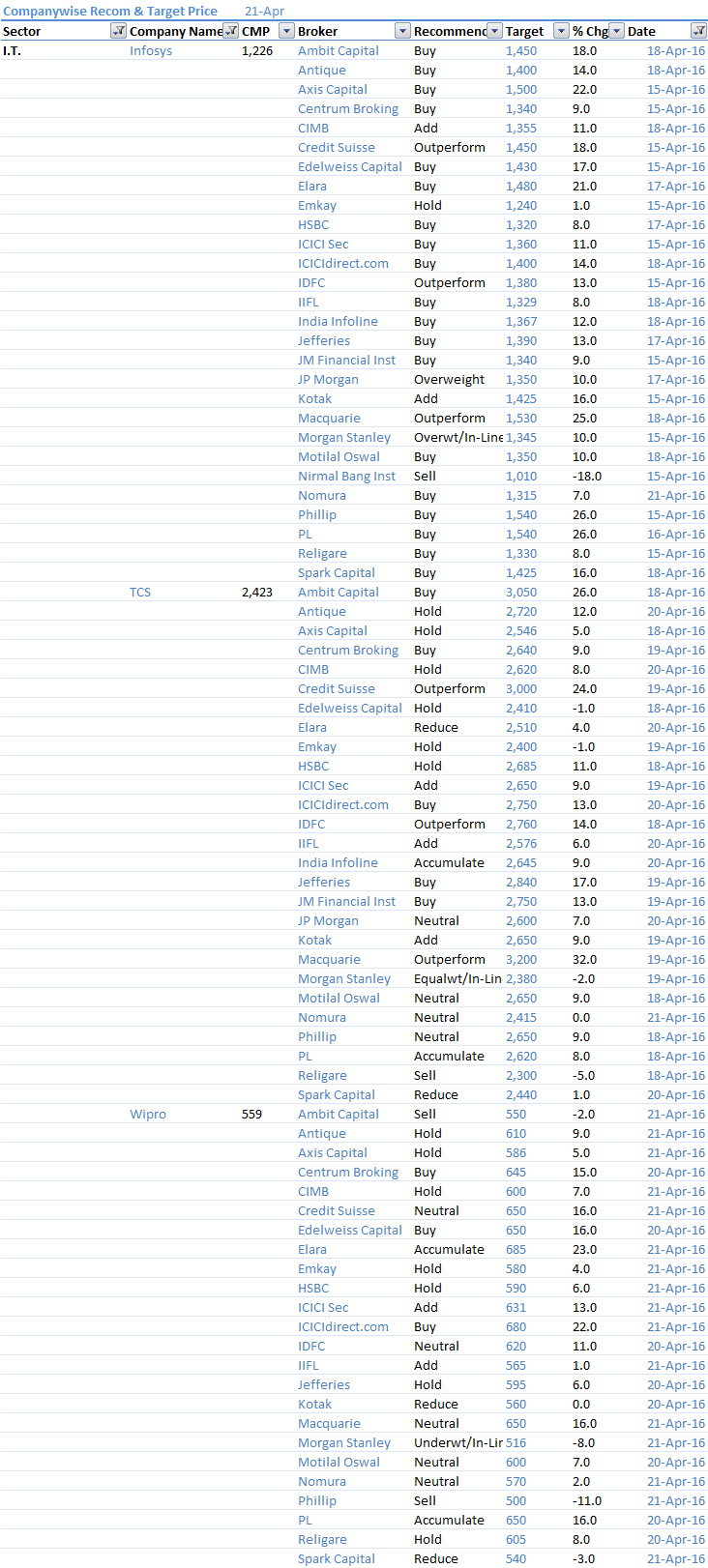

To my surprise, they not only missed the bounce in IT sector but they did exactly opposite, instead of adding IT during this time, they reduced exposure in IT stock. Even if they added exposure in IT, they did in Wipro, which is the only non performing stock in IT space.

Further, they are selling companies which looks more promising companies to layman like me. L&T, HDFC Bank, HDFC, Indusind Bank, Yes Bank, Tech Mahindra, HDFC Standard Life, D-Mart, Bajaj Finserve, Kotak Mahindra Bank are the stock which they are reducing. And Stocks like NTPC, SBI, Wipro, Bharti Airtel, Idea are the ones where they think there is more value. Most of the stocks which they reduced, had significant stock price jump during these 5 months and stock which they added, fell more. They sold Midcap IT stocks like Mphasis, L&T Infotech, Mindtree which run up by 50-60%.

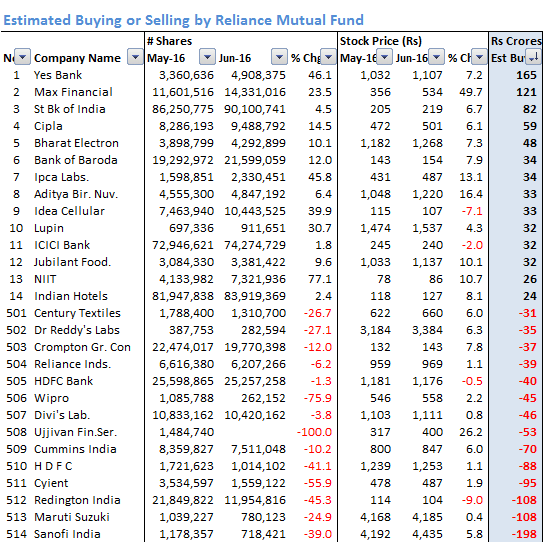

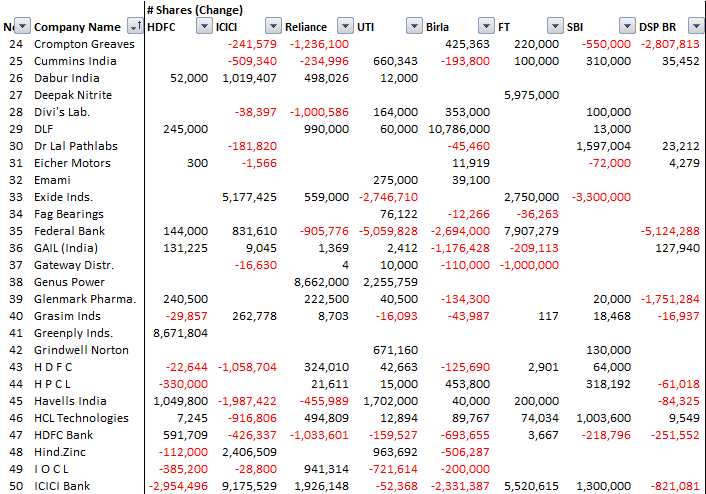

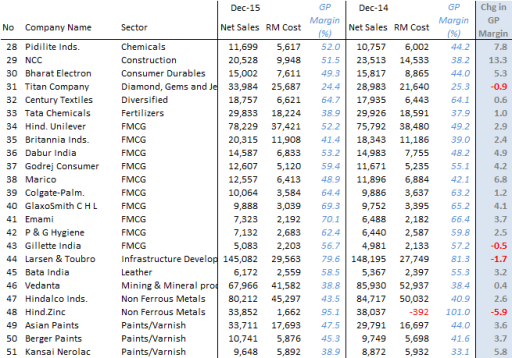

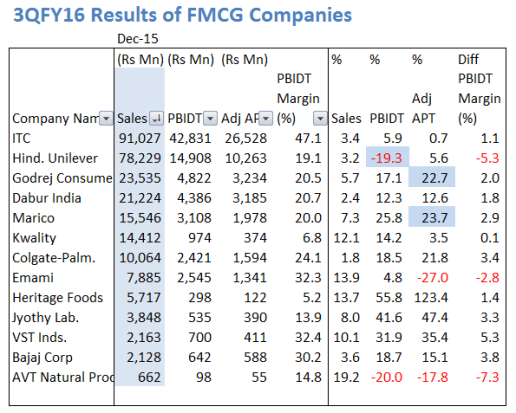

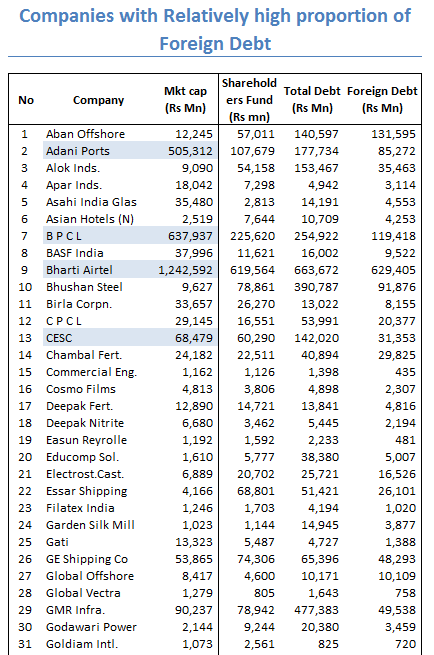

Nonetheless, I have placed 6 tables where one can see significant addition/reduction in Largecap, Midcap and Small Cap stocks and take cues which are the stocks to look forward.